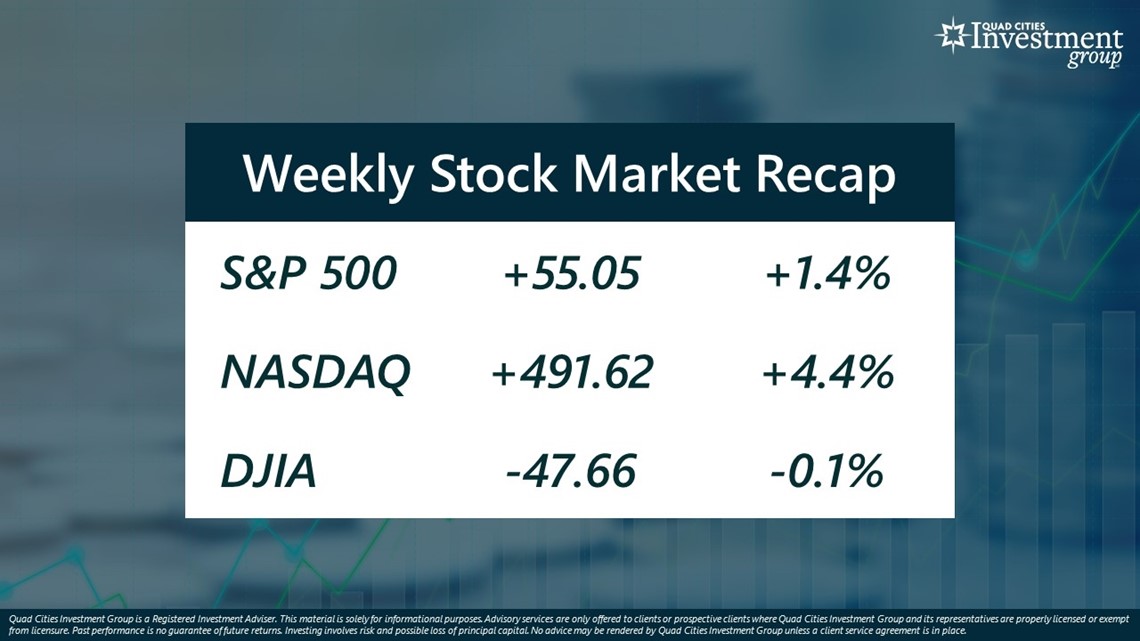

MOLINE, Ill. — Over the last week, the benchmark S&P 500 stock index rose 1.4%, NASDAQ increased 4.4% and DJIA is down 0.1%.

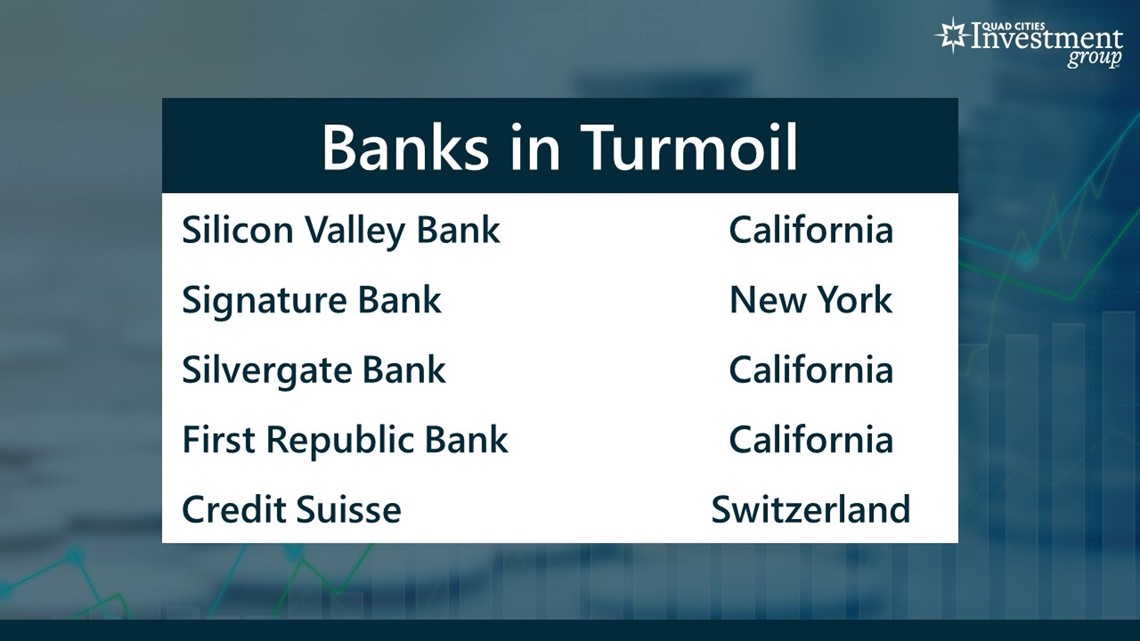

On March 10, California-based Silicon Valley Bank collapsed, making it the second-largest bank failure in U.S. history. But just two days later, New York-based Signature Bank collapsed, which was the third largest bank failure in U.S. history. Over the past week, a number of other banks have either closed or required financial rescue packages to remain operating.

Bohlman: There are a lot of people wondering if this is similar to the 2008-09 financial crisis. In what way is this the same or is this something completely different?

Grywacheski: These five banks got into peril not by some structural flaw within the financial system but by extremely poor management decisions that put its financial stability at risk. It really started with Silicon Valley Bank (SVB). SVB made these massive bets that interest rates would remain low. Obviously, interest rates have soared. And that created catastrophic losses. When news got out, it created this rush by depositors to withdraw their money but the bank didn’t have the cash to satisfy the demand and it collapsed.

So, this triggered a rush by depositors to pull their funds from other banks that also had a history of mismanagement and cautionary flags being raised.

- Signature Bank (SB) served as a bank for the extremely volatile and high-risk CC industry.

- For both SVB and SB, the US government will be reimbursing all deposits, even above the $250K FDIC insurance limit. This combined amount could exceed $100 billion. But stockholders and creditors are most likely out of luck.

- Silvergate Bank voluntarily shut its doors but said 100% of all deposits will be returned. Silvergate also had very close ties to the CC industry.

- First Republic received $30 billion in funding from a number of Wall Street banks to shore up its cash positions.

- Credit Suisse, Switzerland’s 2nd largest bank, received $53 billion in funding from the Swiss National Bank, which is equivalent to the U.S. Federal Reserve.

- Both First Republic and Credit Suisse have had significant internal problems for quite some time.

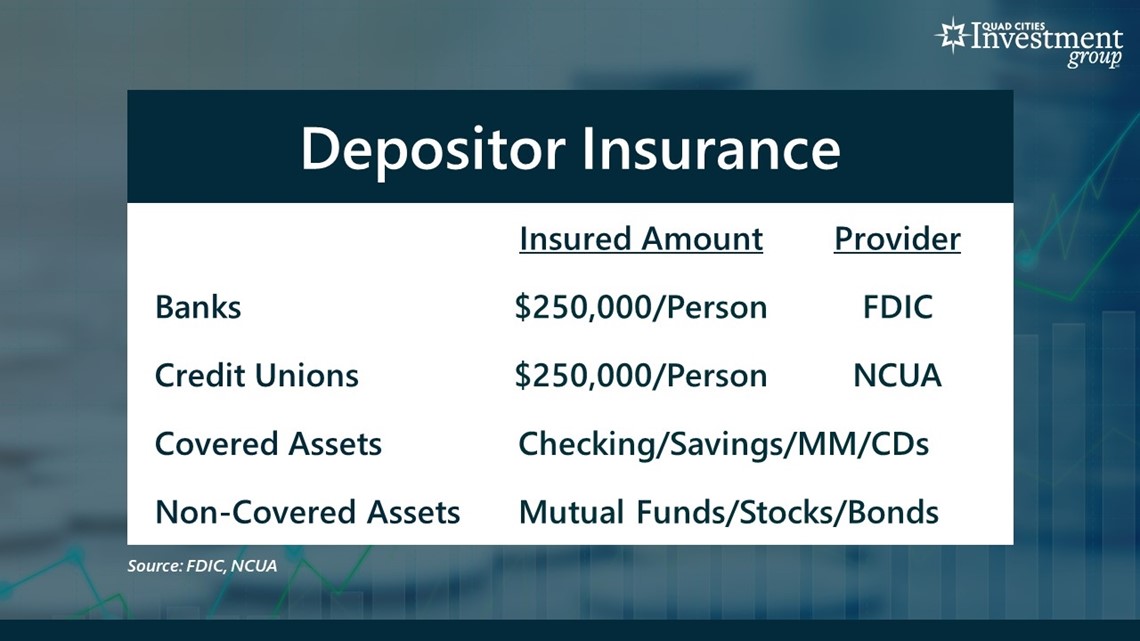

Bohlman: If a bank or credit union does fail, to what extent are customer deposits protected?

Grywacheski: The vast majority, but not all of banks and credit unions provide some type of insurance coverage. For banks, that coverage is provided by the Federal Deposit Insurance Corporation. For credit unions, it’s the National Credit Union Administration. For both banks and credit unions, it’s $250,000 per person/institution. For example, if you have $200,000 in a checking account and $200,000 in a savings account, if that bank or credit union fails, only $250,000 total is covered. If you have $250,000 at Bank A and another $250,000 at Bank B, both of those would be covered because that $250,000 insurance limit applies to each banking institution. Money you have in checking, savings, money markets or CDs are under the umbrella of protection. But any money you have in mutual funds, stocks, bonds or annuities are not covered.

Bohlman: On Thursday, the NCAA Division 1 men’s basketball tournament started. Not only does the tournament attract a lot of viewers, but it also generates a lot of wagering!

Grywacheski: The near month-long tournament is one of the most heavily wagered sporting events in the country! For this year’s tournament:

- 68M Americans will place some type of wager. This represents about 25% of the US adult population and is above the 50M who wagered on the Super Bowl back in February.

- The total dollar-value of these wagers is a massive $15.5B.

- The number of people entering bracket contests is 56.3M.

- The estimated dollar-value of lost productivity, from people either watching the games or following the tournament while at work, is $17.3B. That’s up $1B from last year.

- Winning your office's March Madness pool and bragging rights for an entire year? Priceless!

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel