MOLINE, Ill. — Over the last week, the benchmark S&P 500 stock index rose 1.9%, NASDAQ increased 2.6% and DJIA is up 1.7%.

Consumer spending is the cornerstone of the US economy. In fact, it drives roughly two-thirds of America’s total economic growth. But just how freely consumers are willing to open up their pocketbooks is often dependent on their level of optimism on the state of the economy.

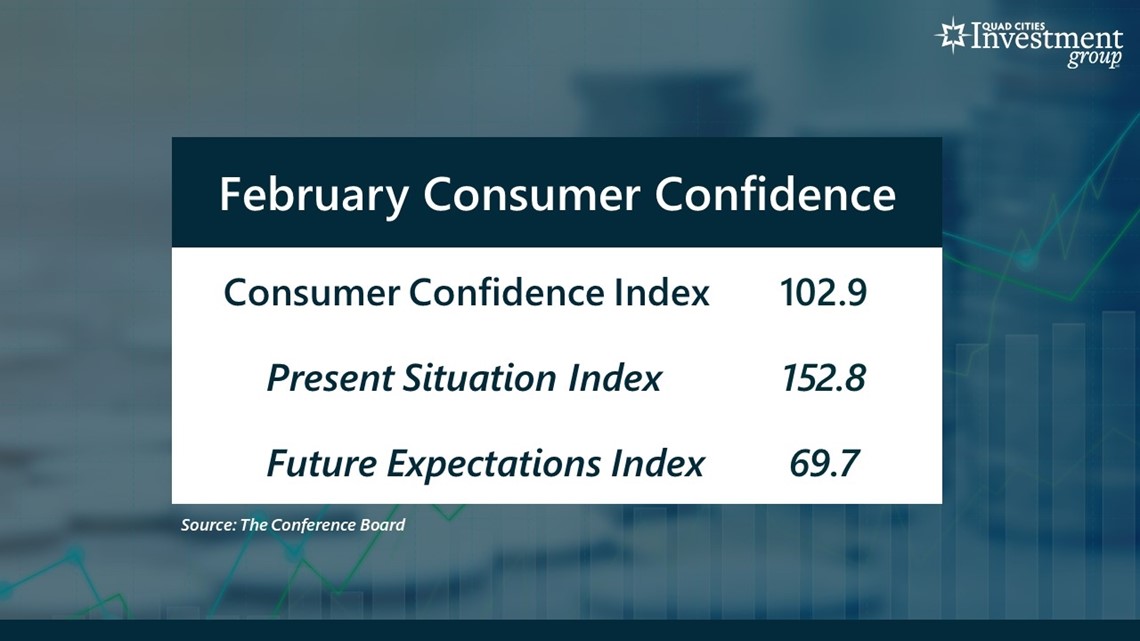

Bohlman: On Tuesday, the Consumer Confidence Index for February was released. What did this latest report say about the current state of consumer optimism?

Grywacheski: The CCI has a benchmark of 100. Any level above 100 indicates an optimism by consumers on jobs, income and the economy. The importance to Wall Street is that optimistic consumers tend to spend their money more freely which ultimately drives the economy forward.

In February, the CCI was reported at 102.9, down from 106 in January and 109 reported in December. With a benchmark of 100, consumers are still confident but just barely.

The CCI consists of two components:

- Their current level of optimism right now- which is very high at 152.8.

- Their level of optimism 6-months down the road- which is extremely low at just 69.7.

Bohlman: You would think that with high inflation, high interest rates and concerns about the economy heading into recession that consumer confidence would be quite low. Why do you think consumers are still confident in the economy?

Grywacheski: To answer that question you really need to break down the CPI into its two components. Typically, current and future levels of consumer optimism tend to ebb-and-flow together. But over the past few months, there’s a growing divergence in consumer attitudes towards their current and future outlook.

This high-level of optimism for the present situation is being driven by a very strong labor market. The national unemployment rate is at a 50-year low of 3.4%. People’s jobs are one of their main sources of security and income. However, all this apprehension of the economy going into a recession in 2023- which puts those jobs at risk- has created a much more pessimistic longer-term outlook.

Bohlman: Since consumer spending is such a large part of the economy, what aspect of consumer confidence will decide if consumers will be willing to spend their money?

Grywacheski: Even though we are starting to see some cracks form in consumer spending, by no means is it falling off a cliff. I would say consumer spending is still fairly robust but weakening.

What really concerns Wall Street is just how low the confidence is for the future outlook. The risk is that if you’re concerned about your job, income or the economy later this year, you might start tightening up your spending or household budgets now. But also, you may now decide to cancel/reduce a lot of those spending plans you had for this summer/fall. Maybe you’ve already decided to cut back on the vacation or home renovation projects you were planning on doing later this year.

Watch more news, weather and sports on News 8's YouTube channel