MOLINE, Ill. — For much of this year, investors have enjoyed a slow but steady rebound in the US stock market. But September turned out to be a very rough month for investors. In September, the S&P 500 fell 4.9%, the tech-heavy NASDAQ lost 5.8% while the Dow Jones Industrial declined 3.5%. For the S&P 500 and NASDAQ, it was their worst performing month in 2023.

News 8's David Bohlman sat down with Mark Grywacheski of the Quad Cities Investment Group to discuss.

Bohlman: Why did we see this sharp and dramatic sell-off in the stock market last month in September?

Grywacheski: For most of 2023 we saw this gradual rise in the stock market on the hope that maybe this inflationary problem was behind us. And that meant that the Federal Reserve wouldn’t have to be as aggressive in raising interest rates. In fact, there was some hope that maybe the Fed would actually begin lowering interest rates.

But over the past few months, we’re seeing more and more evidence that high inflation is becoming imbedded within the economy and that high inflation is now expected to be with us for another three more years. This means the Fed will now have to keep interest rates higher-for-longer.

And the longer we have high inflation and high interest rates, the greater the risk the economy dips back into recession. And that anxiety is being reflected in the stock market.

Bohlman: What’s your advice to investors in light of this September decline in the stock market?

Grywacheski: This is a stock market that’s going to require patience. Again, it comes back to those three issues:

1. When does inflation get back down to 2%?

2. When does the Federal Reserve finally ease up on raising interest rates and to actually lowering interest rates?

3. Can we avoid a recession?

Until we get some clarity on those three questions, I think the stock market will remain quite volatile and choppy.

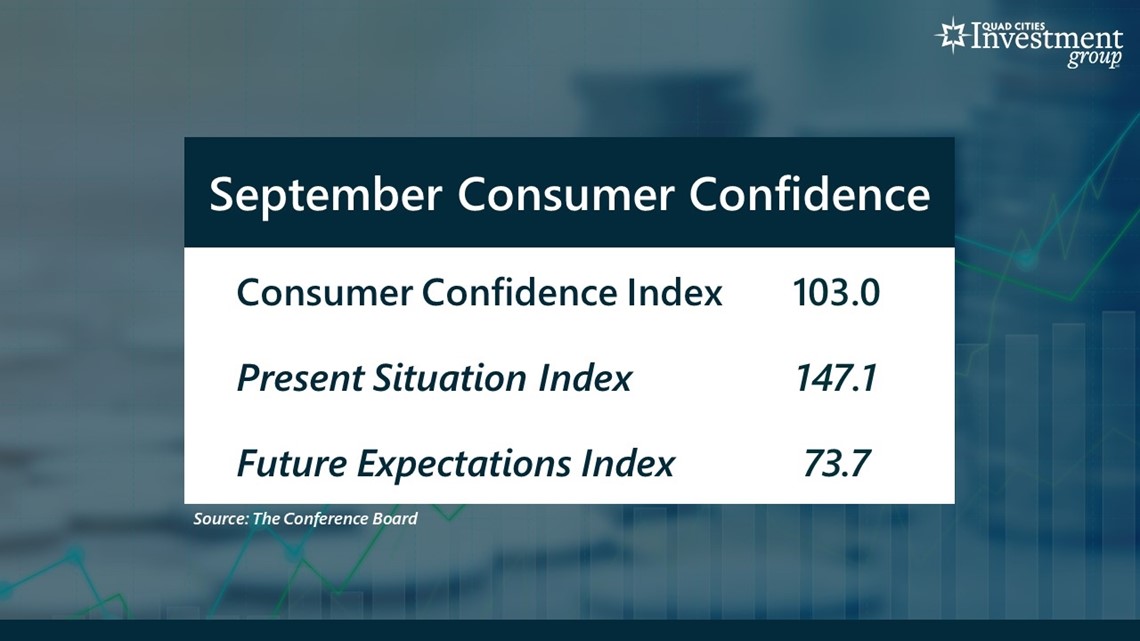

Bohlman: On Tuesday, the Consumer Confidence Index for September was released. What did this latest report say about the current state of consumer optimism?

Grywacheski: The CCI has a benchmark of 100. Any level above 100 indicates an optimism by consumers on jobs, income and the economy. The importance to Wall Street is that optimistic consumers tend to spend their money much more freely which ultimately drives the economy forward.

In September, the CCI was reported at 103, a 4-month low. With a benchmark of 100, this means that consumers are still confident but just barely.

Now, the CCI is made up of two components:

1. The level of optimism for your present situation- which is very high at 147.1. So, in the short-term, consumers have a fairly high level of optimism.

2. The level of optimism for 6-months down the road- which is extremely low at just 73.7. So, in the longer-term, consumers’ anxiety over high inflation, high interest rates and the risk of a recession have created a much more pessimistic outlook.

Watch more news, weather and sports on News 8's YouTube channel