MOLINE, Ill. — If recession is a recipe, some of the ingredients are starting to come together to make the perfect - or not so perfect - dish.

On Monday, March 28, Good Morning Quad Cities Financial Expert Mark Grywacheski talked about the reasons why we may be heading towards a recession, starting with something almost every person reading this is dealing with: Rising gas prices.

"Unfortunately, we should expect high gasoline prices for quite some time," he explained. "Gasoline, along with diesel fuel and jet fuel, is derived from crude oil and crude oil is a global commodity - subject to global forces of supply and demand. Crude oil production in the United States is well below the record volume we once had and that flood of U.S. crude oil we once produced helped keep the global price of crude oil low.

Now though, we’re much more reliant on Russia and OPEC to meet our crude oil needs. However, we now have a ban on Russian crude oil, which drives up prices even higher. So, if we’re not going to produce that extra crude oil here in the U.S., where are we going to get it from?"

To see where you can find the lowest gas prices in the QCA, click here.

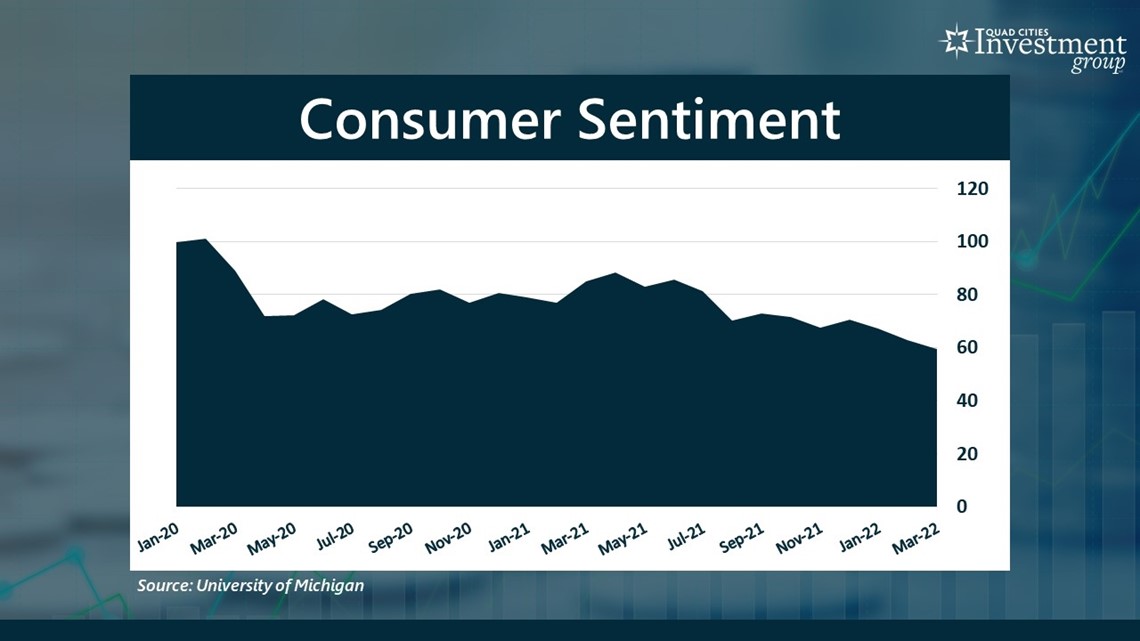

The other "ingredients" in the recession recipe include rising inflation and something called the Consumer Sentiment Index, a monthly report put together by the University of Michigan … and it's not good news. Its last CSI reported that consumer optimism is now at a 10-year low.

"The Consumer Sentiment Index tracks consumers’ perception of their financial situation and the biggest factor behind this consumer pessimism is inflation," Grywacheski said. "These rising prices are taking a massive toll on household budgets. Inflation has been steadily rising over the past 12 months, and you see that corresponding decline in the Consumer Sentiment Index."

Grywacheski continued, saying this could start impacting consumer spending - which makes up two-thirds of the U.S. economy.

"Rising inflation and low consumer optimism is not a good combination," he warned. "We continue to see additional downgrades for economic growth in 2022 and there’s growing concern that prices simply get so high that consumer spending comes to a grinding halt and sends the economy into recession."

To see/hear the rest of Grywacheski's conversation with News 8's Angie Sharp on GMQC, click the video above.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.