MOLINE, Ill. — Financial Advisor Mark Grywacheski with Quad Cities Investment Group recapped the strong stock market sell-off this April and gave his thoughts on whether the U.S. economy appears to be heading toward another recession Monday, May 2 with News 8's Angie Sharp on Good Morning Quad Cities.

Find our full conversation below.

Grywacheski: So far this year, the stock market has not been kind to investors. The ongoing sell-off in stock prices continued on Friday. The S&P 500 fell 155 points, the Nasdaq lost 536 points while the DJIA fell 939 points. The S&P 500 and Nasdaq closed on Friday at their lowest price in 2022.

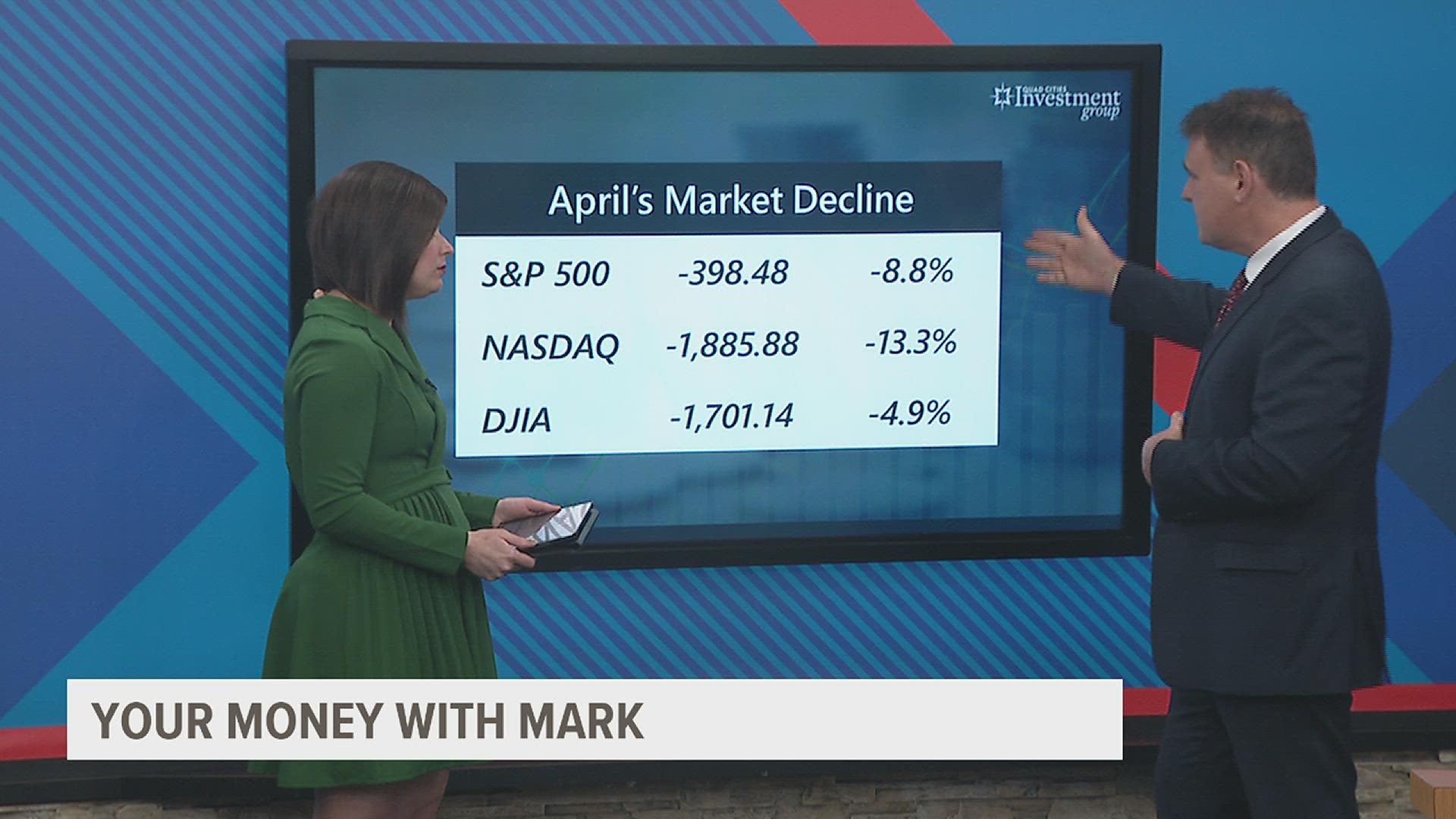

Sharp: April was an especially painful month for investors. Why did we see such a strong sell-off in the stock market last month?

April was a very rough time for investors. For the NASDAQ, its monthly decline of 13.3% was its worst April performance since 2008. For the S&P 500 (-8.8%) and DJIA (-4.9%), it was their worst April performance since 1970.

More and more companies are starting to raise some cautionary flags about their ability to drive earnings/revenues 6/9/12 down the road. It’s this concern over inflation, rising interest rates and the strength of the economy ("Will we see another recession?"). All this apprehension over the future outlook is being reflected in this stock market decline.

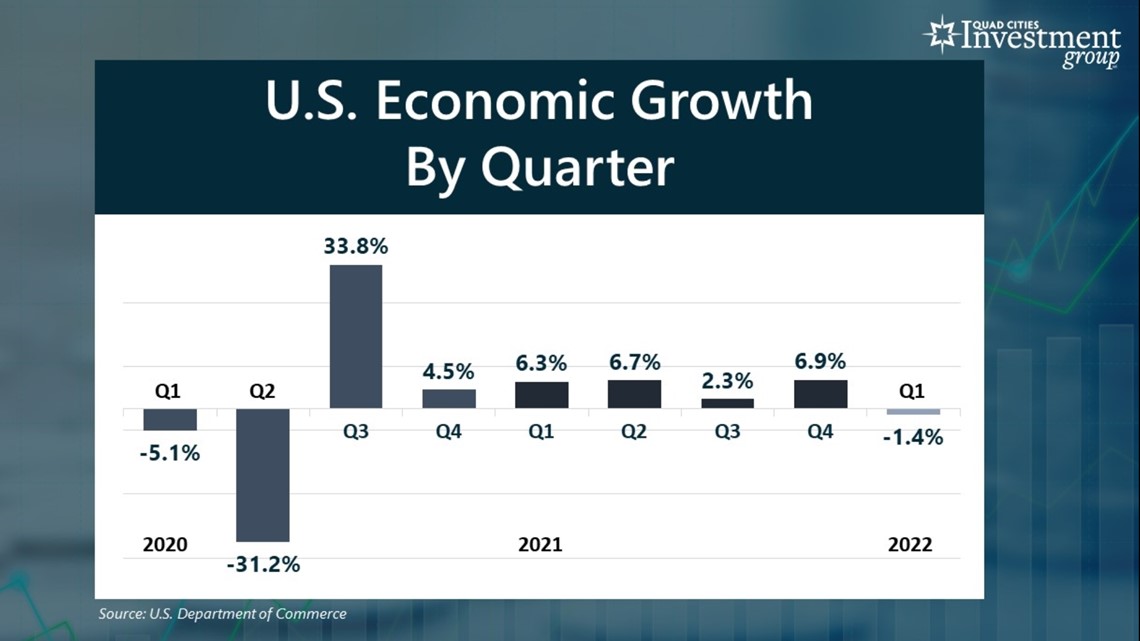

Regarding the economy, on Thursday, April 28, the Department of Commerce reported that the U.S. economy actually shrank at an annualized rate of 1.4% in the first quarter. What are your thoughts on this latest report?

In the first quarter, Wall Street was expecting the economy to grow at an annualized rate of 1.1%. Instead, it actually contracted by 1.4%.

After the initial impact of the pandemic back in the first and second quarter of 2020, we saw this economic surge in the third and fourth quarters and through all of 2021 as the economy/businesses reopened and millions of people returned to work.

But as I said in the second half of last year, as we get into 2022, a lot of these recovery tailwinds will have disappeared and economic growth would be much tougher to come by. For Wall Street, the concern was would we see a slow, gradual decline to a more normal pace of economic growth or a very sharp decline in growth. And on Thursday, unfortunately, we got our answer.

What are your thoughts on the growing concerns the economy is heading for another recession?

A recession is defined as two consecutive quarters of negative growth. We just got our first quarter of negative growth and all we need is the 2nd quarter to post negative growth and we’re technically in a recession. We are expected to return to a positive growth rate in the 2nd quarter.

But I think the main concern over recession is later this year and into 2023. To get this inflation under control, the Federal Reserve is projecting seven 0.25% rate hikes this year plus an additional three more in 2023. The risk of having 10 0.25% interest rate hikes in such a compressed period of time is that it places tremendous strain on consumers, businesses and, ultimately, the economy.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.