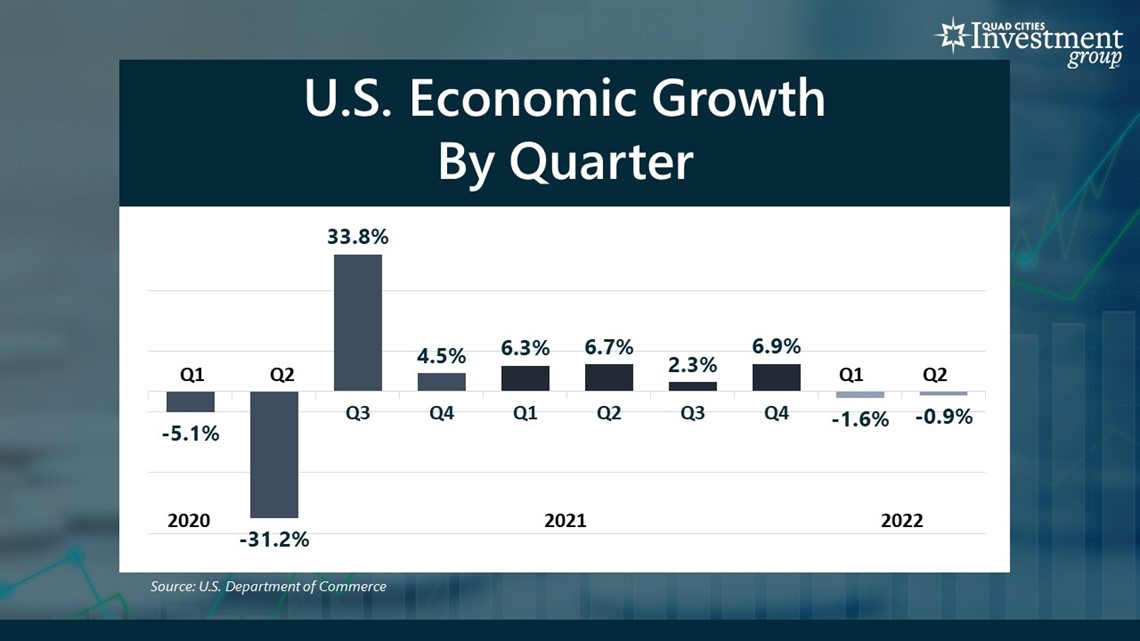

MOLINE, Ill. — On Thursday, July 28, the U.S. Department of Commerce released its latest Gross Domestic Product report, which reported that economic growth in the second quarter contracted at an annualized rate of 0.9%. This follows the first quarter’s negative growth rate of 1.9%.

Financial Advisor Mark Grywacheski with the Quad Cities Investment Group spoke with News 8's David Bohlman about the negative growth and contrasted how Wall Street and the National Bureau of Economic Research define a recession.

Bohlman: Over the last six months, there’s been a growing discussion on the health of the U.S. economy. What were your initial thoughts when this report came out on Thursday?

Grywacheski: The first six months of the year have caught much of Wall Street by surprise. In the first quarter, Wall Street was expecting the economy to grow at an annualized rate of 1.1%. Instead, the economy contracted by 1.6%. In the second quarter, Wall Street was expecting the economy to grow at an annualized rate of 0.5%. Instead, the economy contracted by 0.9%.

Since the beginning of the year, there’s been growing concern the economy would eventually head into recession. But the general consensus was that if we did get a recession, it would most likely happen towards the end of 2022 or the first half of 2023. Instead, we get a technical recession in the very first two quarters of this year.

In your opinion, what do you think are the main factors behind this sudden decline in the economy?

There are a couple of key factors. First, after the initial economic shutdown from the pandemic, we saw this surge in economic growth and the labor market as government-imposed mandates and restrictions were lifted: businesses reopened, people started going back to work and there was a pent-up consumer demand (people were now free to go to movie theaters, ball games, take vacations).

But as I said throughout 2021, as we start approaching the end of 2021/early 2022, many of those economic tailwinds start to subside. Any economic growth going forward has to be earned- much of the “free ride” was coming to an end. And second, this very high inflation- and now we get rising interest rates- has created a very potent combination that has placed a tremendous strain on consumers, businesses and the economy.

We’re seeing this tremendous divide on whether or not we are actually in a recession. Based on your experience, what do you think?

There are two different definitions being thrown around:

The first is the longstanding benchmark of two consecutive quarters of negative economic growth- which we just got on Thursday. This is the basic definition that’s been used for decades. For over 14 years, I was a professional trader and that’s how I, other traders, the financial media and much of Wall Street defined a recession. I spoke to some former trading colleagues on Wall Street on Friday and asked them their thoughts: And they said, "Yes, two consecutive quarters of negative economic growth - it’s a recession."

Now, whether it goes into the official history books of the US economy as a recession is determined by the National Bureau of Economic Research. They consider other factors such as the labor market, industrial production and consumer spending. And most likely, they’ll wait and see how the economy and these other factors play out over the coming months before they make any decision. However, any decision on whether a recession is deemed to exist or not comes down to a judgment call. In other words, the NBER doesn’t input an array of economic data into a computer, press a button and out pops a piece of paper that says either “recession” or “not a recession.”

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.