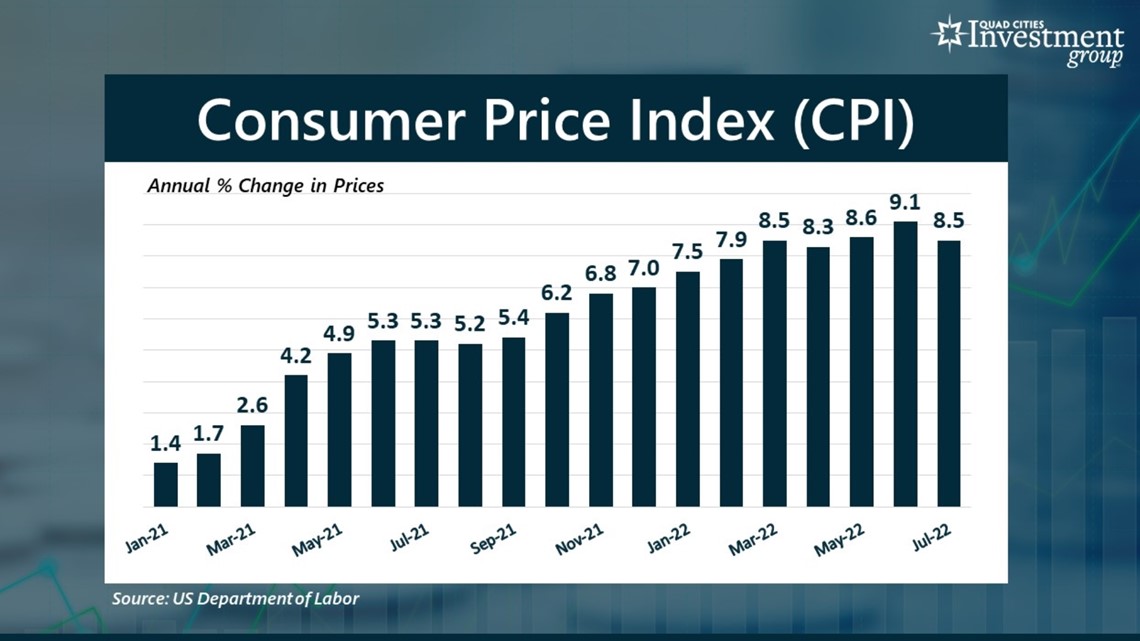

MOLINE, Ill. — Over the last 18 months, inflation has taken a heavy toll on American consumers. According to a recent study by Moody’s Analytics, rising consumer prices cost the average American household nearly $6,000 per year in higher costs.

But in July, the national rate of inflation declined. This left many Americans wondering where inflation goes from here.

Monday, Aug. 15 on Good Morning Quad Cities, Financial Advisor Mark Grywacheski with the Quad Cities Investment Group spoke to News 8's David Bohlman about whether the downward trend will be short- or long-term.

What are your thoughts on this latest inflation data?

In July, inflation fell from 9.1% to 8.5%. Wall Street was actually expecting a rate of 8.7%. Any decline in the inflation rate is a good thing, but we have to keep this in perspective. It doesn’t mean that consumer prices have suddenly declined. It simply means that the rate of increase has gotten smaller.

With an inflation rate of 8.5%, consumer prices have risen, on average, by 8.5% over the past 12 months. And when you consider the ideal, target rate of inflation for our economy is just around 2%, we have a long way to go before we get back to some sense of normalcy.

What do you think was behind this sudden decline in inflation we saw in July?

When you take a closer look at the data, the main driver was a reduction in energy prices. After rising 7.5% in June, energy prices fell by 4.6% in July. However, energy prices are still 33% higher than 12 months ago.

Whether this decline is short-term or long-term becomes more of an unknown and will be heavily influenced by America’s energy policy and geopolitical events.

Obviously, the question that everyone wants to know is do you think inflation will continue to decline, or do we see yet another spike a few months down the road?

Unfortunately, we simply don’t know. Wall Street has a very divergent opinion on this question.

Back in April, inflation suddenly declined from 8.5% to 8.3%. Even then, many Wall Street heavyweights argued that inflation had peaked. Likewise, you had an equally large faction on Wall Street arguing that inflation could quickly ramp up again in the upcoming months.

Fast forward to today and those very same arguments on Wall Street persist. Some argue inflation peaked in June at 9.1%. Others caution inflation could easily surge higher again in the upcoming months.

You’ve said many times on this segment you see inflation remaining historically high for quite some time. After this latest data on inflation, do you still feel that way?

I do. Whether June’s rate of 9.1% turns out to be the peak of this inflationary cycle or not, I still think we’ll see a very gradual decline back to that target rate of 2% we’d like to get to. We’ve seen some improvement in the labor shortage and supply chain issues, but this inflation is being driven by way too much money that’s flooded the economy.

Inflation is too much money chasing too few goods. There are currently 40% more dollars floating around the economy than there were back in February 2020. That’s an inherent recipe for inflation.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.