MOLINE, Ill. — Illinoisans have a constitutional amendment on their ballots this fall. It's a change to the tax law found within the state's constitution. The question: should Illinois change from a flat income tax to a graduated income tax?

The Flat Income Tax

Right now, Illinois uses a flat tax, meaning everyone in the state pays the same tax rate at 4.95 percent. It doesn't matter if you make $10,000 a year or $10 million a year; everyone pays the same rate.

A Graduated Income Tax

Governor JB Pritzker and the coalition "Say Yes to Fairness" are pushing for a change. They want what's called a graduated income tax. This would allow Illinois lawmakers to tax different income levels at different rates. The main idea is to tax lower earners at a lower rate and higher earners at a higher rate.

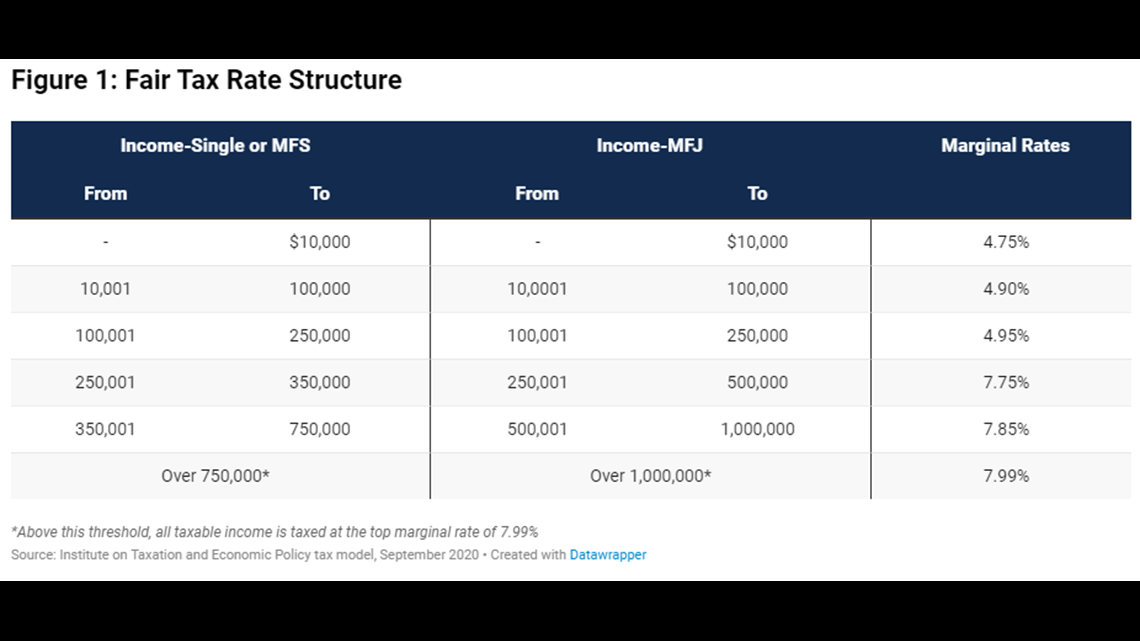

Below are the tax rates lawmakers locked in in May 2019. These are the rates that will go into effect January 1, 2021, if this proposal passes this November.

You can see tax rates would now range from 4.75 percent up to nearly 8 percent for the top earners.

Supporters hold this would not impact retirement or Social Security income, although opponents say it opens the door for a new tax on those types of income.

Arguments for a Graduated Income Tax

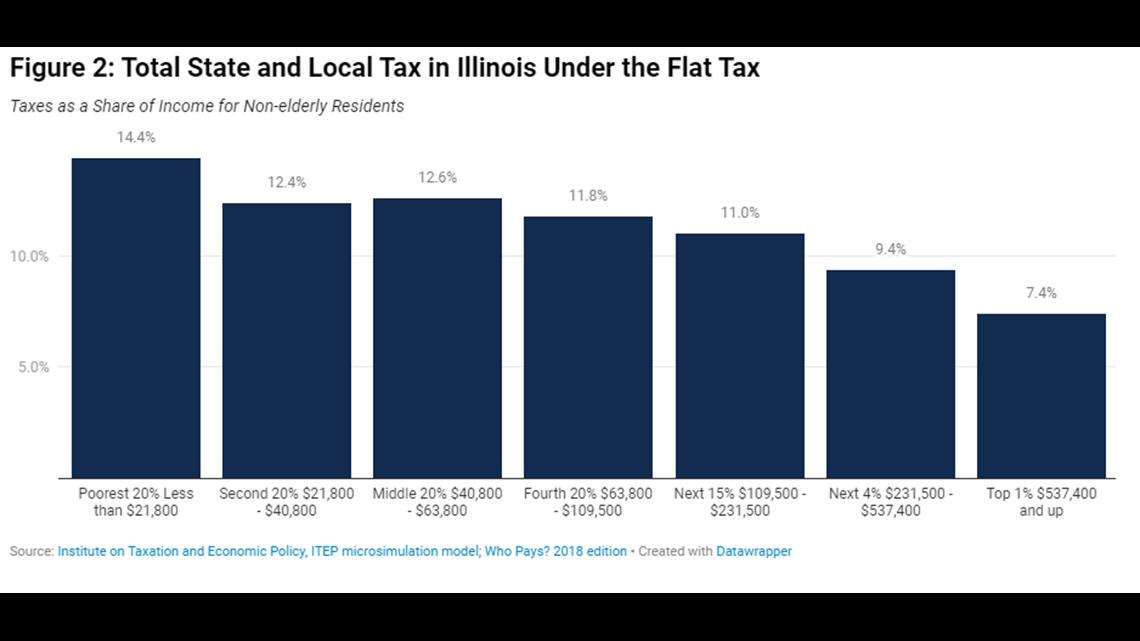

"Say Yes to Fairness" says the flat tax right now isn't fair for workers in the state. They refer to an analysis from the Institute on Taxation and Economic Policy. It found the bottom 20 percent of Illinois earners pay 14.4 percent of their income in state and local taxes combined. That's compared to the top one percent which loses 7.4 percent of their income to taxes.

"Say Yes to Fairness" argues a graduated income tax starts to address this disparity by providing a tax cut for lower and middle-income households and raising taxes on higher earners. It says 97 percent of Illinoisans will see a tax cut if this passes and the increased taxes on millionaires and billionaires will bring in $2.9-3.4 billion in additional tax revenue.

Arguments Against a Graduated Income Tax

Several coalitions have formed in opposition to this proposed tax amendment, including the "Coalition to Stop the Proposed Tax Hike Amendment."

This coalition argues the proposal gives politicians more power to raise taxes on everyone, including lower and middle-income families. Opponents argue the tax brackets should be integrated into the proposal itself, which simply changes how many tax rates and tax brackets the General Assembly can create.

It also says it'll negatively impact 100,000 small businesses in the state by raising their income taxes. And it adds some businesses could cut jobs or leave the state because of a tax increase, taking jobs and wages with them.

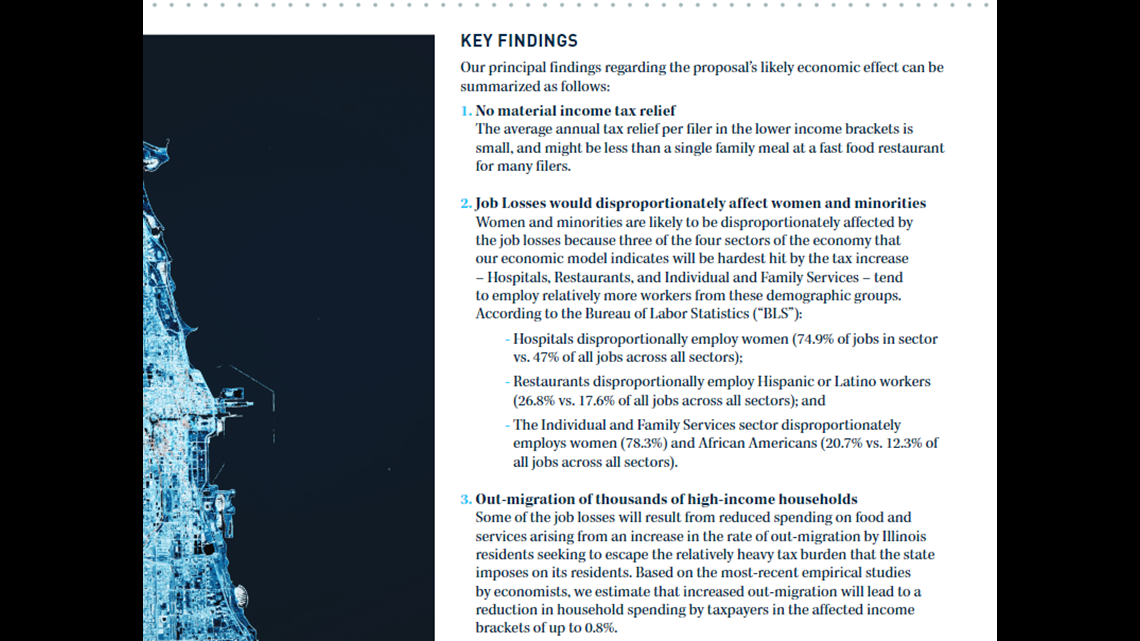

Many of these arguments come from an analysis from the Berkeley Research Group. Its analysis of the proposal found this proposal would save some families enough money in a year for one meal at a fast-food restaurant. It also suggests businesses that greatly employ women and minorities will be hardest hit because restaurants, hospitals, and family care businesses will be hit hardest. And that could result in job losses.

The "Coalition to Stop the Proposed Tax Hike Amendment" says right now is the worst time to make this change, with many families and businesses struggling because of COVID-19. They said it would raise taxes on those already hurting.

More to Consider

- "Say Yes to Fairness" says the graduated income tax would raise taxes for businesses making more than $250,000 a year. However, for example, co-owners can each claim half on their taxes. So two owners pulling in $300,000 together could each claim $150,000 and actually get a tax cut with the graduated income tax.

- Right now, nine states, including Illinois, have a flat tax. Thirty-two states and Washington D.C. have graduated income taxes. Nine states don't have any income tax.

- AARP notes Tennessee doesn't tax wages currently and is moving away from an income tax on interest and dividends in 2021.

- New Hampshire, which doesn't tax wages, is also phasing out its interest and dividends tax by 2025.

- See how your taxes could change with a graduated income tax. There's a calculator on the Governor's website.