When it comes to YOUR MONEY, we want to take it a step further. That's why Mark Grywacheski appears on Good Morning Quad Cities every Monday to give us his analysis of the latest business, economic, and financial news.

The markets are closed on September 2nd due to the Labor Day Holiday, but Mark came in to review the current state of the US stock market and what's been driving all of the latest volatility.

"In June and July we saw this big surge in the stock market- sending the DJIA to an all-time-high of 27,350. This 2-month surge was triggered on June 3, when the Federal Reserve stated it would now be willing to start lowering interest rates. Remember, as the Fed lowers interest rates, it lowers the cost of borrowing. This stimulates consumer/business spending and helps boost economic growth. But then in early August we start getting these further escalations in the US-China trade dispute that triggers a 1,500-point selloff and all this volatility. Last week we did see a bit of a rally on some softening of tensions and that negotiations should restart sometime this month," said Grywacheski.

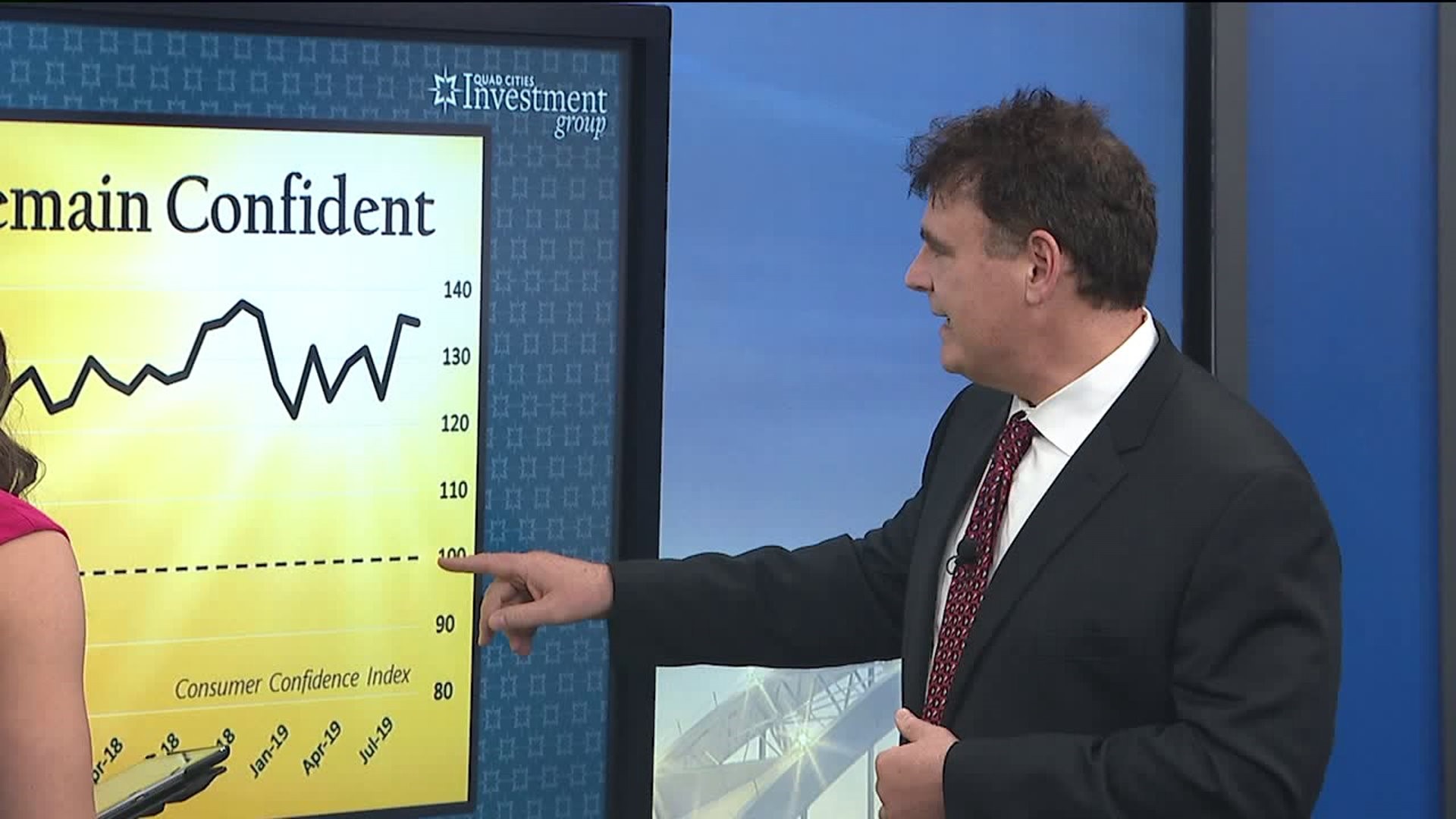

Mark also went over the results for August's Consumer Confidence Index and his thoughts on the results.

"In August the index was reported at 135.1- still near a 19-year high. August was the 36th consecutive month with an index level above 100. Despite an increasingly weak global economy, repeated escalations in the US-China trade dispute volatility in the stock market, American consumers remain extremely optimistic on their economic future," said Grywacheski.