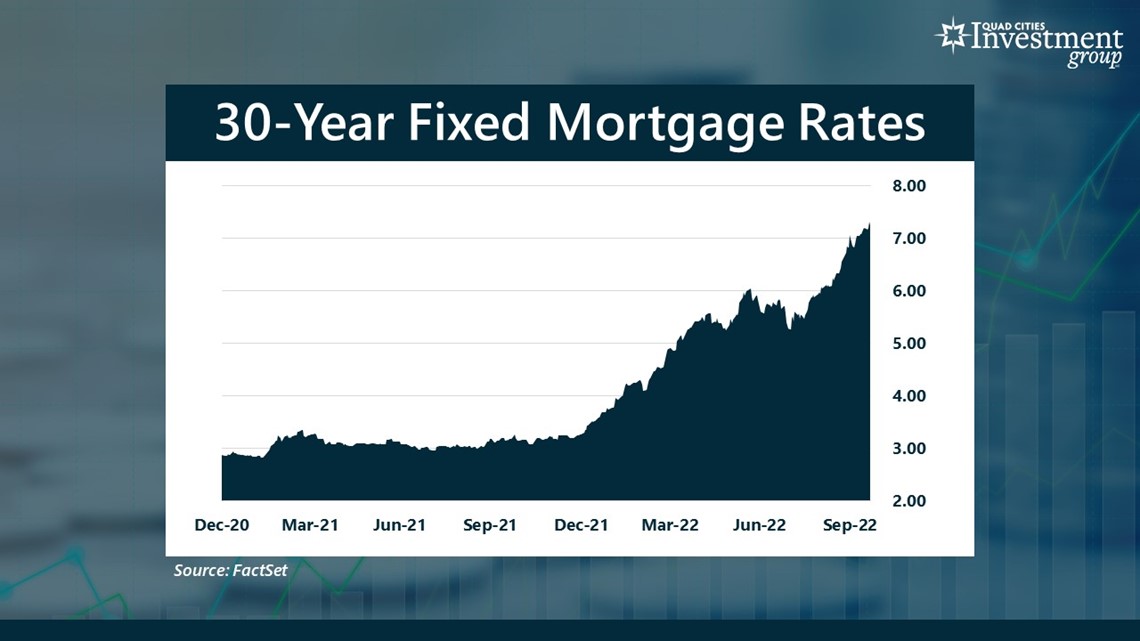

MOLINE, Ill. — For most Americans, buying a home is the largest purchase they will ever make. But a combination of rising home prices and rising mortgage rates has many experts projecting we could see a collapse in the housing market. Over the past 12 months, the average rate on a 30-year fixed mortgage has risen from 3.2% to 7.2%, the highest in 22 years.

Financial advisor Mark Grywacheski joined Good Morning Quad Cities' Ann Sterling live on the show to discuss the housing market's outlook.

Sterling: Do you expect another housing bubble similar to the one we had back in 2007-08?

Grywacheski : I do think we could see some type of contraction in the housing market but not to the extent of what we saw back in 2007-08. In 2007-08, we had a massive oversupply of homes and a lot of speculators buying a home simply as an investment to make money. And once that consumer demand and speculation started to dry up, that excess inventory of homes helped send price plummeting.

But for the past 2+ years, the surge in home prices was related more to the fact that the labor shortage and supply chain constraints limited the construction, and therefore the availability, of homes.

Currently, we are starting to see some continued weakness in the housing market. Over the last 12 months, the number of homes sold has fallen by 24%. But home prices are still higher by 8.4%!

It’s because of that limited inventory of homes we had over the past 2+ years where prices will likely decline but not to the extent of what we saw in the collapse of the housing market back in 2007-08.

Sterling: Given all the uncertainty we’re now seeing in the housing market and the fact we’re hearing more and more concern about the US economy going into recession next year, is it still a good time to buy a home right now?

Grywacheski: It really becomes an issue an affordability. Despite the decline in sales, home prices are still 8.4% higher than they were last year. Over the past 12 months, the average rate on a 30-year mortgage has risen from 3.2% to 7.2%. For a $300K home with a 20% down payment, that higher mortgage rate is now costing you an extra $500/month.

But I don’t think it’s anything that prevents you from buying a home for you and your family. Yes, mortgage rates are at 7%. But it’s far from the 16%-18% rates we had back in the early 1980’s. Once rates do go back down, you can consider refinancing at a lower rate.

But now is not the time to overspend on your home. Shop around for the best mortgage rate you can get and stick to a home that you can afford.

Sterling: What do you say to people who are trying to time the market and delay purchasing their home until mortgage rates come back down?

Grywacheski: Interest rates, in general, are expected to remain fairly high for the rest of the year and most likely throughout all of next year. Now, whether interest rates (along with mortgage rates) go higher or lower will ultimately depend on the state of inflation. If inflation remains stubbornly high, interest rates and mortgage rates will likely remain high as well.

But that inflationary outlook is still quite cloudy. So, it’s going to be extremely difficult to try and time your housing purchase to exactly when mortgage rates will finally start to decline.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch "Your Money with Mark" segments Mondays during the 6 a.m. hour of Good Morning Quad Cities or on News 8's YouTube channel.