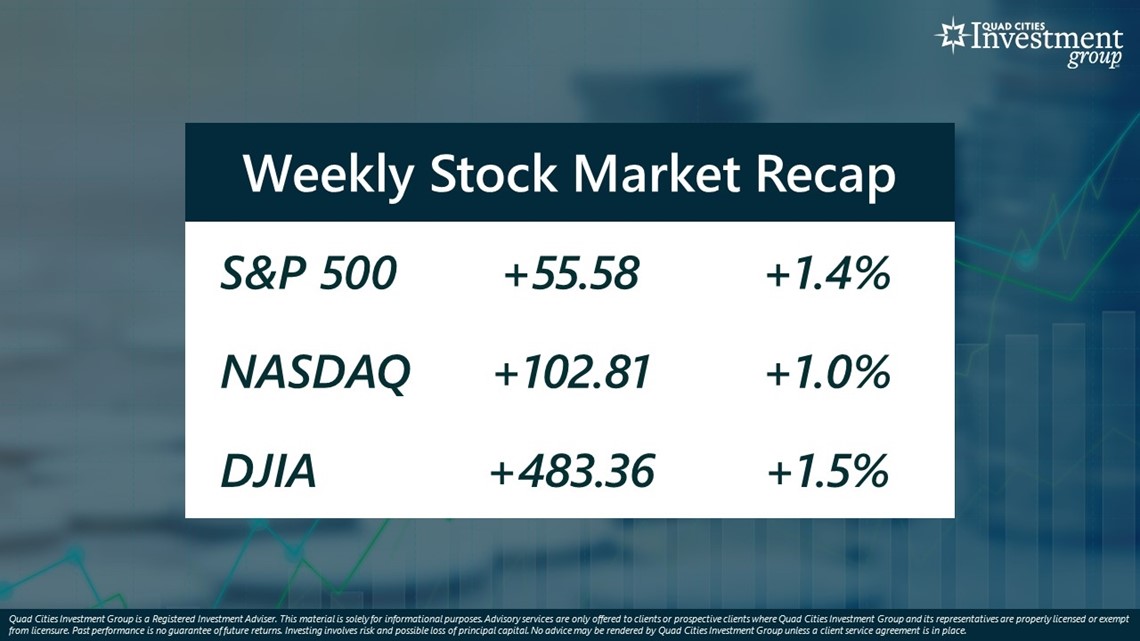

MOLINE, Ill — Over the last week, the benchmark S&P 500 stock index rose 1.4%, NASDAQ rose 1.0% and DJIA rose 1.5%.

Mark Grywacheski with the Quad Cities Investment Group joined WQAD's David Bohlman to discuss the stock market and inflation outlook for 2023.

Back in June, the national average for a gallon of regular gas reached $5.08. According to the U.S. Energy Information Administration, it was the first time ever that the national average exceed $5 per gallon.

But over the past six months, gas prices have been steadily declining. Today, the national average is down to $3.33 per gallon. Below you'll find the full conversation between Grywacheski and Bohlman from Jan. 9.

Bohlman: What’s caused this recent decline in gas prices over the past six months?

Grywacheski: A single barrel of crude oil ultimately gets refined into a number of distillate products: gasoline, diesel fuel, jet fuel, kerosene, heating oil. Over the past six months, we’ve seen this gradual decline in the price of crude oil, which then makes these distillate products, like gasoline, cheaper.

At any given moment there are a number of global factors that influence the price of crude oil. But the main factor right now is this overarching concern the U.S., the EU and much of the global economy will fall into some type of recession this year.

On the plus side, consumers are finally seeing some downward pressure on energy prices, including gasoline. But on the negative side, it conveys this tremendous apprehension of a significant slowdown in both the US and global economies.

Bohlman: But why are energy prices falling now when these potential recessions here in the U.S. and around the world haven’t even started yet?

Grywacheski: Even though the U.S. and many global economies have yet to enter a recession, there’s an overwhelming conviction that these recessions will happen, or at a minimum, there will be a sizable slowdown in economic activity. When an economy goes into a recession, or suffers a severe economic slowdown, there’s less economic activity:

- Consumers are buying fewer goods and services.

- Factories and businesses are producing fewer goods and services.

That lower economic activity requires less energy consumption: crude oil, natural gas, diesel fuel, gasoline. In anticipation of this economic slowdown, suppliers of energy have already started to reduce their purchases of energy products which inherently drives down the price.

Bohlman: Why do gas prices tend to vary so significantly from one state to the next?

Grywacheski: One of the main factors is the state’s distance from the refineries or its proximity to pipelines and transportation infrastructure. Texas, Oklahoma and many states near the gulf coast or the major hubs of crude oil production have cheaper transportation costs.

But then there are the taxes that each state imposes on a gallon of gasoline. Illinois and California have some of the highest gasoline taxes in the country. And then there are some cities, like Chicago, that add on their own separate tax.

Bohlman: So, this begs the question – how do Illinois and Iowa compare to the rest of the nation in terms of gas prices?

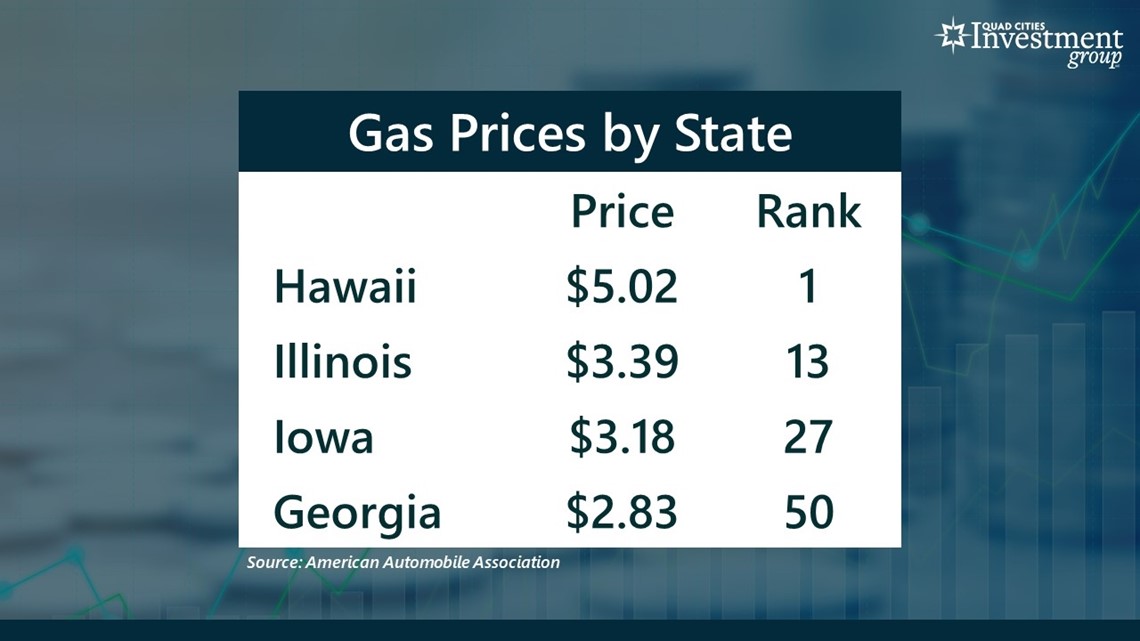

Grywacheski: The state with the highest average price is Hawaii at $5.02/gallon. Hawaii and California typically battle it out for the highest price in the land.

The cheapest state is Georgia at just $2.83/gallon.

Illinois ranks #13 at $3.39/gallon. If you go to Chicago, that average jumps to $3.83.

Iowa is at #27 at $3.18/gallon.

Here in the Quad Cities, it’s about $0.20 a gallon cheaper to fill up on the Iowa side of the river.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel