MOLINE, Ill. — Last week, the S&P 500 rose 2.5%, the Nasdaq gained 3.3% and the Dow Jones Industrial Average increased by 2%. Despite the week's gains, the U.S. stock market is in the middle of a seven-month decline that’s caused investors a lot of pain and anxiety. So far this year, all three major stock market indexes have suffered significant double-digit losses.

Monday, July 25 on Good Morning Quad Cities, Financial Advisor Mark Grywacheski with the Quad Cities Investment Group spoke with News 8's David Bohlman about the state of the stock market and how investors can best navigate it.

Bohlman: What are your thoughts on the state of the stock market?

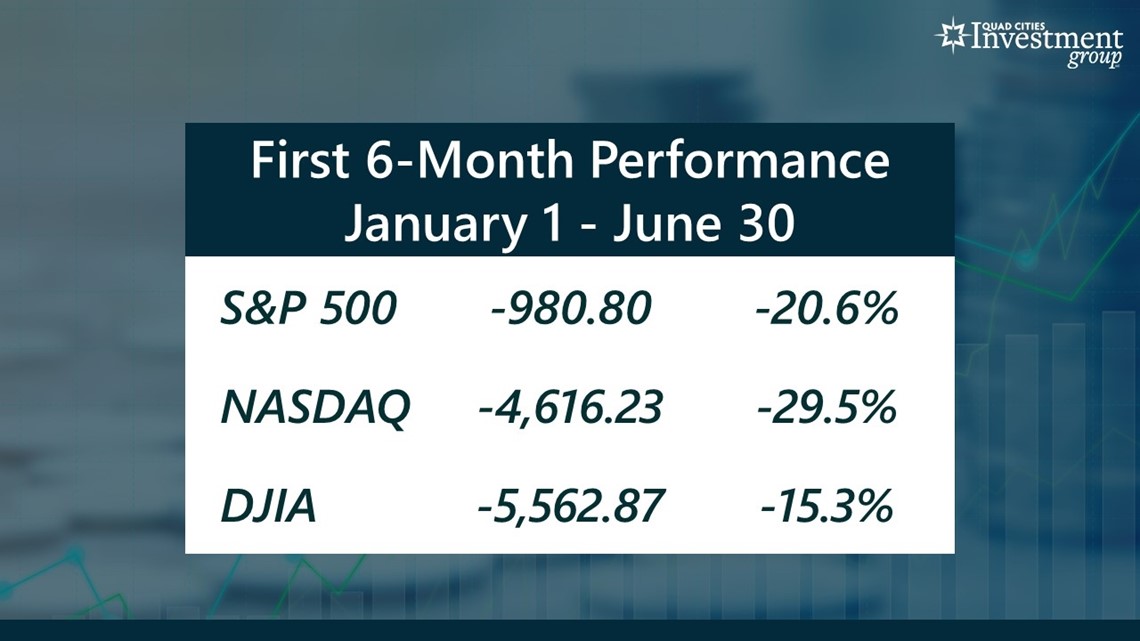

Grywacheski: In the first three weeks of July, we have seen a slight rise off the lows of this seven-month decline we’ve seen across the U.S. stock market. But the graph below shows just how significant this sell-off has been.

In the first six months of the year, the S&P 500 lost 20.6%, its worst performance going back to 1970. The Nasdaq lost 29.5%, its worst performance in the entire history of the Nasdaq stock index. The Dow Jones Industrial Average lost 15.3%, its worst performance since 1962.

The stock market often serves as a proxy for the health of the U.S. economy. This sell-off is caused by high inflation, rising interest rates and the growing concern that the economy is heading towards a recession.

What’s the difference between these three indexes, and in your opinion, which ones might you follow more closely than the other?

There are a lot of different stock indexes, but these are the three major ones that Wall Street typically mentions.

The S&P 500 is often referred to as the “broader” stock market index as it tracks the stock performance of the 500 largest publicly traded companies in the US.

The Nasdaq, often referred to as the “tech-heavy” Nasdaq, tracks the performance of over 3,000 companies. Many of them are in the technology sector. Technology has been and will be a driving force within the U.S. economy.

Finally, the Dow Jones Industrial Average is the oldest stock market index, created about 130 years ago. But the Dow Jones is only comprised of 30 stocks. In today’s economy, it really doesn’t capture the breadth of the stock market like to S&P 500 or the Nasdaq, which captures the influence of the technology sector.

But it’s really the top two - the S&P 500 and Nasdaq - that Wall Street relies on.

As we get into the second half of this year, what are your thoughts for investors on how to best navigate the stock market?

If there’s one takeaway from this week’s segment it’s this: Respect the unknown for how this market might play out in the second half of this year.

There are a lot of uncertainties:

- To what extent will inflation start to decline?

- To what extent will the Federal Reserve continue raising interest rates?

- Does the economy go into recession?

- If so, when and to what extent? Will it be short-term/mild or longer/more severe?

My advice:

- Stay diversified. There’s a time and a place to become a bit more aggressive in your portfolio. Now is not the time.

- Be patient. In the entire 130-year history of the U.S. stock market, the market has always recovered and went on to set new all-time highs. We just don’t know how many days/weeks/months that will be.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.