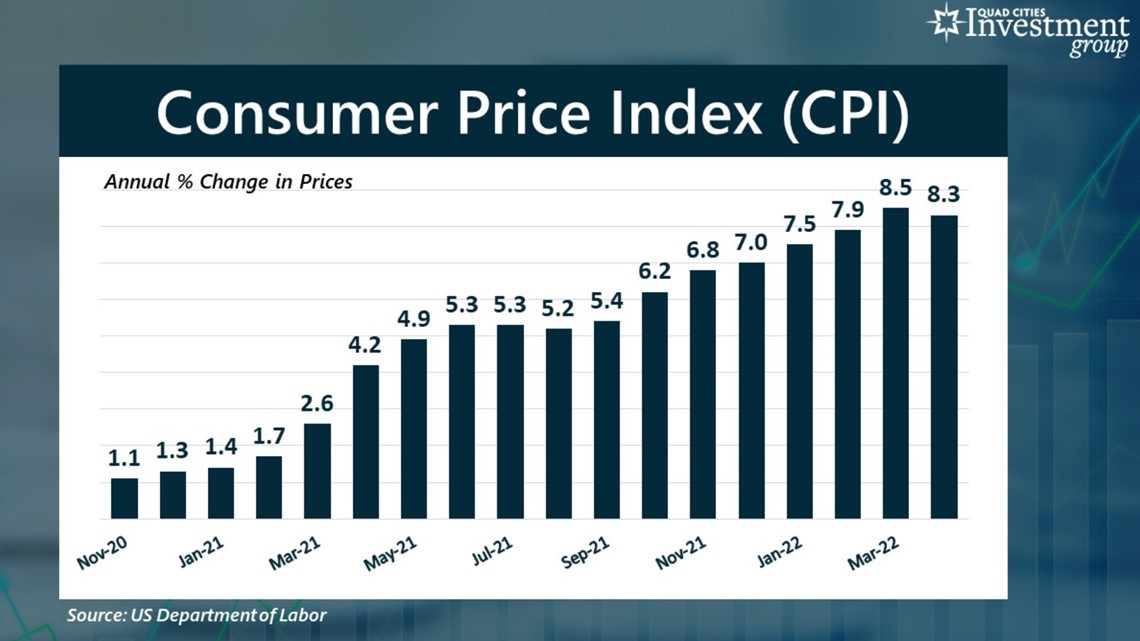

MOLINE, Ill. — Monday, May 16 on Good Morning Quad Cities, Financial Advisor Mark Grywacheski of the Quad Cities Investment Group discussed with WQAD's Angie Sharp the relationship between inflation and interest rates and the U.S. Department of Labor's latest inflation report, which shows inflation is expected to remain high.

Sharp: We keep hearing that inflation is causing much of this ongoing sell-off in the stock market, but we’re also hearing that rising interest rates are the cause. So, which is it? Inflation or interest rate hikes?

Grywacheski: They’re closely tied together. Because inflation is so high, the Federal Reserve is now forced to step in and start raising interest rates. This makes it more expensive to buy things on credit (credit cards, bank loans, mortgages, etc.). The goal is to reduce consumer/business spending, which helps lower prices. But this has a negative impact on the economy.

Historically, when the Fed starts raising interest rates, Wall Street wants these interest rate hikes to be gradually spread out as much as possible to allow the economy to better absorb the impact. But because inflation has risen so high so fast, the Fed is now forced to frontload most of these interest rate hikes within the next few months. That sudden shock to the economy from all these interest rate hikes in such a short window of time increases the risk of sending the economy into recession.

On Wednesday, the Department of Labor reported that inflation in April fell from 8.5% to 8.3%. What are your thoughts on this latest report on inflation?

The report was somewhat of a mixed bag. On the positive side, inflation did decline from 8.5% to 8.3%. But on the negative side, Wall Street was expecting inflation to drop to 8.1%. So, despite the modest decline, inflation is still running hotter than expected.

Many Wall Street experts are saying that inflation peaked in March at 8.5% and that inflation should start to decline. Do you agree with that?

I don’t know if March was the de facto peak of this inflation. Could it possibly jump back up in the next few months? Yes. But I do think that within the next few months inflation does start to gradually decline.

But even with that gradual decline, inflation is expected to remain high for quite some time. Let’s assume by year-end inflation has fallen to 5%. That’s still well above the ideal target rate of inflation of about 2%.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.